- Home

- Publications

- Is The US Yield Curve Signalling That A Recession Is On The Way?

Is the US Yield Curve Signalling that a Recession is on the Way?

Sign in to Access Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

This content is restricted to corporate members, NiGEM subscribers and NIESR partners.

Authors

Related Themes

Macro-Economic Dynamics and PolicyThis is a preview from the National Institute Economic Review, May 2019, no 248.

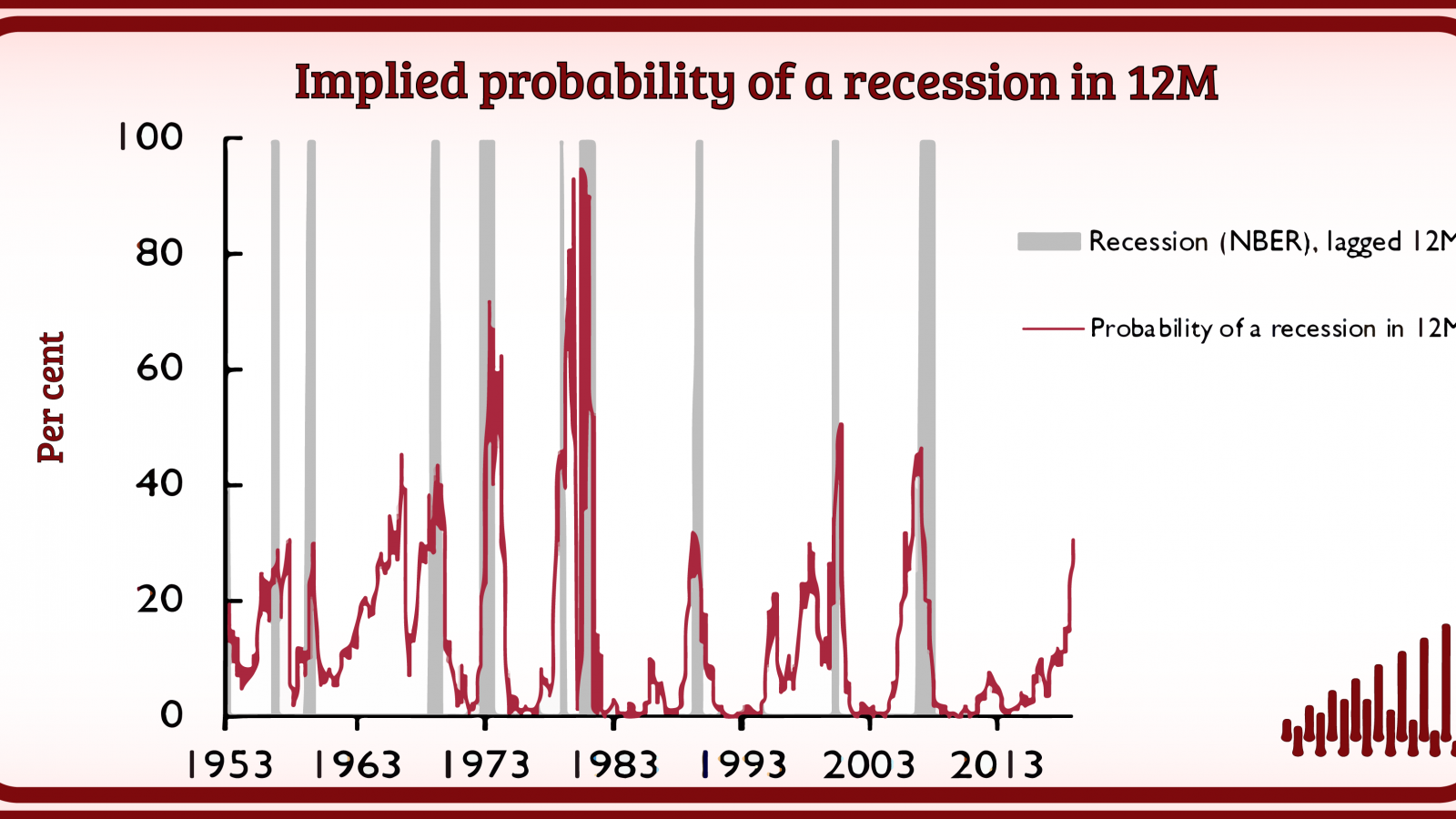

Inversions of the yield curve have a good track record of predicting recessions (see Estrella and Mishkin, 1998; Chinn and Kucko, 2015). The 10-year to 3-month spread between US Treasury yields became briefly negative between 22 and 28 March 2019, spurring debate about whether this was signalling a forthcoming recession.

In this box, prepared by prepared NIESR Senior Economist Cyrille Lenoel, we discuss the signal provided by the flattening of the yield curve and the possibility of this resulting from a more permanent shift that goes beyond the current business cycle.

"The key issue is whether in current economic and financial conditions the yield spread is as informative as it used to be. It might be the case that asset purchases by the Federal Reserve have distorted the signal from the yield curve. (..) An inverted yield curve may signal a high risk of recession the following year as it has done successfully on several occasions in the past. But our forecast based on a wider range of economic data does not support this view".

Related Blog Posts

Public Debt Sustainability and Fiscal Rules

Stephen Millard

Benjamin Caswell

05 Feb 2024

4 min read

Related Projects

Related News

Call for Papers: Lessons From Quantitative Easing & Quantitative Tightening

09 Feb 2024

1 min read

Related Publications

The Financial (In)Stability Real Interest Rate, R**, as a Monetary Policy Constraint

07 Feb 2024

Global Economic Outlook Box Analysis

Geopolitical Risks and the Global Economy

07 Feb 2024

Global Economic Outlook Box Analysis

The Spectre of a US House Price Correction

07 Feb 2024

Global Economic Outlook Box Analysis

Inflation Differentials Among European Monetary Union Countries: An Empirical Evaluation With Structural Breaks

20 Nov 2023

National Institute Economic Review

Related events

Assessing Cycles and Structural Changes in Markets

Business Conditions Forum

2022 Dow Lecture: The Economy and Policy Trade-Off