And Now, On US Inflation?

With the path and duration of the pandemic, and its interaction with the economy, unknown and unprecedented how should US monetary policymakers respond? Peter Doyle argues that the first step would be to admit that the authorities are “flying blind” and that it would be best if everyone—on all sides of transitory—stopped implying otherwise.

My earlier blog On US inflation now, issued in September at the peak of the third wave of Covid, proposed a three-part trigger for the Federal Reserve to begin withdrawal of pandemic monetary stimulus:

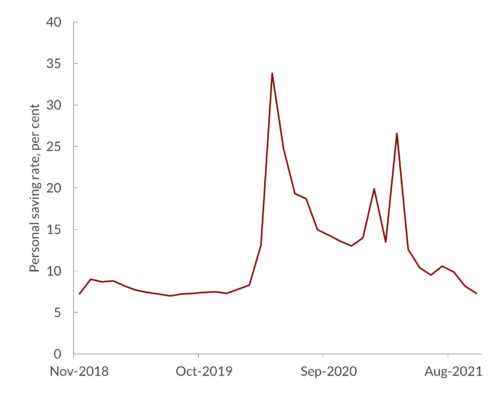

- personal savings rates below pre-pandemic levels

- underlying nominal wage growth destabilizing; and

- above-target inflation appearing in trimmed mean PCE, excluding base effects.

Given the uncertain outlook for the pandemic, the usual lags in monetary transmission, and the electoral constraints on fiscal response if pandemic worsened in 2022, an election year, that trigger reflected that policy should not be tightened until unambiguous signs had emerged that sustained inflationary pressures were appearing in the nucleus of the consumer price structure.

Since then, those conditions have been met (see charts below).

- The personal savings rate dropped to 7.3 percent in October, albeit still in the pre-pandemic range.

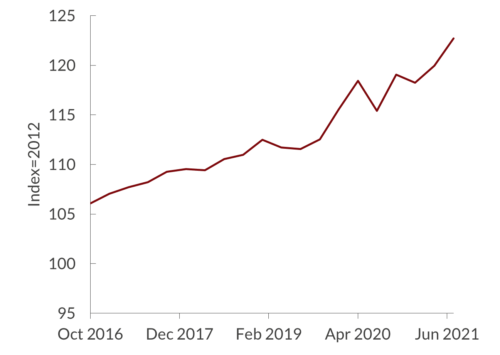

- Non-farm business sector unit labor costs rose moderately above pre-crisis trend.

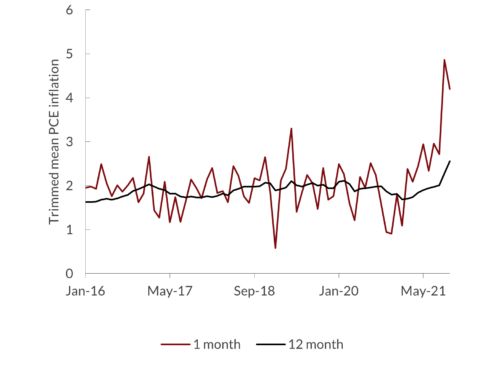

- The annualized m-on-m trimmed mean PCE rose to 4.9 percent and 4.2 percent in September and October.

Given the combination, it is hard to fault the timing of the announcement of tapering in November.

Accordingly, the core monetary policy question has changed: no longer is it a matter of when tightening should begin but whether or not the action taken is appropriate.

On that, the Federal Reserve Chair appears to have already changed his mind, proposing a faster taper (with others following suit). But with the last monthly trimmed mean PCE down, non-farm payrolls weak, Covid infection rates rising, and Omicron, his shift may have more to do with his just announced re-nomination than with new data.

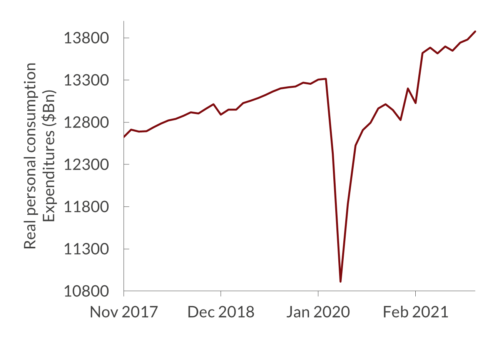

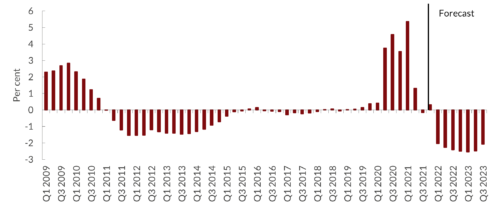

In any event, the underlying macroeconomic issue is not, as the original inflation alarmists proposed, a simple case of an oversized Covid stimulus package in early 2021 generating excess demand. Demand remains at pre-pandemic trend, and fiscal support, even including the bipartisan infrastructure plan has already been sharply withdrawn (see charts below).

Real Personal Consumption Expenditures

And the apparently unfalsifiable probabilities the original leading alarmist proffered—one third each for stagflation, recession, and fast non-inflationary growth—have been confounded by the emergence of high growth alongside high headline inflation instead.

The attempt to rescue the original alarmist framing by noting that headline inflation reflects demand and supply shocks is tautological rather than informative, and suggestions that NAIRU may have risen during Covid is speculative given the poor state of knowledge about pre-pandemic Phillips curves.

Instead, the challenge in making the assessment for monetary policy settings now is that the key factor—the path and duration of the pandemic and its interaction with the economy—is unknown and unprecedented. So we are essentially flying blind.

Economists’ default processes in such contexts—to run the usual macro models assuming either that the pandemic ends quickly or has no significant economic effect, and compulsively comparing outturns to earlier short-term forecasts—are Hamlet without the Prince and unhelpful as they both reveal essentially how little was and is known rather than substantive information.

And if monetary policymakers not only hope for but presume “the best” about the pandemic, policy will tend to be too tight.

Furthermore, strategic hunches and prioritizing which errors to avoid, provide little guide:

- Concern to avoid a post-pandemic recession if inflation overshoots is counterbalanced by risk of an immediate recession if pandemic worsens and current policy is thus too restrictive;

- Concern, if the pandemic worsens again, that price pressures will be aggravated by further supply-chain-problems given expenditure switching from services to goods are counterbalanced by the observation that the net supply/demand effect in early 2021, prior to covid-era expenditure switching, was to reduce consumer prices overall and by the sharp falls in oil prices since Omicron;

- Assurance that everyone has learned to live without lockdowns is counterbalanced by observing that the biggest driver of economic downturn in 2021 was autonomous spending adjustments, not lockdowns, and that “mild symptoms” include many that are really bad, which people will anticipate.

And with the overdue retirement of the word “transitory” from Fed discourse, the horizon over which monetary policy should be targeted also emerges as a key matter. Accordingly, given that pandemic produces considerable noise in prices, the Fed should expressly maintain its focus on post-pandemic circumstances, even if those turn out to arise more than 18 months hence.

That counsel reflects both that monetary policy typically does not attempt to fix supply issues and that with reversals probable—once pandemic ends—in consumer spending on goods brought forward, inventory accumulation, and in early retirements and other Covid-related falls in the supply of labour, the monetary stance appropriate to check the immediate price effects of these factors will likely overshoot that required post-pandemic, whenever that materializes.

In this context, however it turns out, Omicron is not—in the Chief Economist of the Bank of England’s infelicitous phrase—a “spanner in the works”. Rather, with Delta surging in the US again, it—and whatever mutations may follow it—is fundamental to monetary calculus.

And in this context, there simply is no straightforward technical economic determination of the appropriate monetary settings.

This state of affairs is, implicitly, recognized even by some economists who raised the most insistent alarms and critiques of Fed policy. Of them, Jason Furman has had the professional integrity to specify recently exactly what policy adjustments he proposes, with Olivier Blanchard’s endorsement—bringing forward the termination of the taper by three months. Given that it is unclear if QE works via stocks or flows or whether it only “works in practice but not in theory”, that proposed adjustment is well within the margin of error of what is known. And while the original alarum anticipated inflation “not seen in a generation”, the policy rate rises alarmists now call for are barely a fraction of the 9 percentage points required at that time, after 1979.

So with dissent symbolic—indeed often performative—rather than substantive, what is to be done with monetary policy now that the trigger conditions have been met?

Mystique and privileged information notwithstanding, the Fed should neither implicitly nor explicitly claim to be able to do things it cannot—i.e., to meet its primary goals continually even in the face of major, unpredictable, and enduring shocks such as Covid.

Instead, with the fiscal already sharply contractionary, it should:

- detail the monetary policy conundra Covid poses, notably unpredictability and the policy time horizon;

- robustly highlight its efforts to respond as best it can in mid-course;

- affirm that far from signaling policy failure in that regard, inflation now and wage rises concentrated in the low income quartile reflect the remarkable successes of the overall fiscal and monetary policy response to the pandemic; and

- it should reassert that its core task—to which it remains implacably committed—is to deliver its primary goals once the shocks pass, however distant that may be and whatever happens meanwhile.

That counsel runs counter to the Administration’s desire to be seen to have the pandemic under control. But that tension is an appropriate expression of the Fed’s independence in the circumstances.

For their part, inflation alarmists should do likewise. They should follow the wise—if not always observed—IMF code of not disagreeing with policymakers absent a substantive firmly-technically- grounded difference of view. At worst, in the difficult conditions prevailing, relentless vague hyperbolic warnings by public-facing economists risk becoming self-fulfilling.

Now that the trigger conditions have been met, it will be a bumpy and uncertain ride. The general public and markets know that. So if both the Fed and economists addressing the public fully acknowledge the professional limitations in prescribing monetary policy for Covid while emphasizing that policy actions are firmly oriented to stability in the post-Covid world, that will do more for credibility and the successful macroeconomic passage through pandemic than anything else.

The opinions expressed in this blog are the personal views of the author, and do not necessarily represent those of the National Institute of Economic and Social Research.