The impact of Brexit abroad – any winners?

The impact of Brexit on the UK economy has been analysed in much detail and NIESR has contributed various model-based analyses (Pain and Young 2004; Ebell, Hurst and Warren 2016; Hantzsche, Kara and Young 2018). Less well understood are implications for the rest of Europe and beyond. This blog post reviews the existing evidence and provides new estimates of the global impact of Brexit.

Post Date

Post Date

Reading Time

Reading Time

The impact of Brexit on the UK economy has been analysed in much detail and NIESR has contributed various model-based analyses (Pain and Young 2004; Ebell, Hurst and Warren 2016; Hantzsche, Kara and Young 2018). Less well understood are implications for the rest of Europe and beyond. This blog post reviews the existing evidence and provides new estimates of the global impact of Brexit. There is consensus that the UK will be affected most by Brexit while European trading partners will face a smaller negative impact on overall economic activity with substantial variation across countries, regions and sectors. UK GDP is estimated to grow by 2 to 9 per cent less compared to continued EU membership, while the impact on the rest of the European Union would be 0.2 to 1.5 per cent of GDP, around one tenth of the impact on the UK economy, with effects being skewed towards a small set of countries. Outside of the EU, there may be scope for countries to benefit somewhat from Brexit in the long run as UK exports become less competitive internationally. But potential gains are unlikely to materialise for some time if Brexit contributes to global trade uncertainty, disrupts international value chains and erodes confidence in regional economic integration.

Bisciari (2019) provides a comprehensive review of the available empirical evidence on the impact of different types of Brexit on European economies. Across studies, the median estimate is that a no-deal Brexit, in which the UK and EU trade on WTO terms indefinitely, would in the long run lead to EU27/eurozone GDP to be lower by 0.6 per cent (standard deviation of 0.4 percentage points), compared to continued British EU membership (figure 1). In contrast, UK GDP is estimated to be 4 per cent lower (standard deviation of 1.7 percentage points). In a scenario in which the UK and EU negotiate a free trade agreement, the impact is smaller in absolute terms, reducing EU27/eurozone GDP by 0.5 per cent (standard deviation of 0.2 percentage points) and UK GDP by 3 per cent (standard deviation of 1.3 percentage points).

Figure 1. Range of Brexit impact estimates (% of GDP relative to EU membership)

Source: Bisciari (2019), NIESR

Note: Based on Bisciari (2019), Table 4, NIESR and Berthou et al. (2019). Studies from the following institutions were included: LSE, IMF, CAE, ifo, CPB, KUL, HM Government, BdE/BdF/Bundesbank.

How vulnerable a country is to Brexit depends on a range of factors, including its current intensity of trade with the UK, its size and openness, the industrial mix, geographic proximity, etc. Within Europe, the estimated impact therefore varies substantially across countries. Ireland is estimated to be hit hardest as a direct neighbour that is very open to trade, in particular with Northern Ireland and Great Britain, while other small economies with strong trade links to the UK, like Malta and Luxembourg are also expected to be affected a lot. The impact on larger economies with less intense trade links, like Italy, is negligible. Mion and Ponattu (2018) estimate that within European countries it is regions closer to the UK in geographic terms that are more vulnerable to Brexit. A sector-level analysis by Vandenbussche (2019) shows that in particular output and employment in the food and beverages, textiles, pharmaceuticals, chemical and petroleum sectors and certain service industries would be affected as they are most intensely linked to the UK through value chains.

The negative economic impact of Brexit on European economies through trade barriers would partly be offset if international investors were to divert foreign direct investment away from the UK into neighbouring countries to retain access to the single market and customs union, and if a more restrictive UK immigration regime would benefit the workforce of EU member states. The impact on productivity is potentially sizeable but could go in either direction as European economies may be better able to attract innovations after Brexit but the UK leaving may also reduce competition within the EU market.

Outside of the EU, the economic impact would depend on the extent to which higher trade barriers between the UK and the EU, which raise the price of traded goods and services, will make imports from the rest of the world relatively more competitive. Given the small aggregate effect of Brexit on output and income in European countries, demand for imports would change little which could be met through trade with external partners. In its April 2019 World Economic Outlook, the IMF estimated that in the near term (by 2021), the impact of Brexit on global GDP would be -0.2 per cent, most of which is accounted for by the impact on the UK and the rest of the EU, with effects being negligible elsewhere.

To provide illustrative estimates of the impact abroad, we analyse Brexit using NiGEM, our global economic model. We focus on a scenario in which the UK and EU negotiate a conventional free trade agreement within 10 years, abstracting from uncertainty around the path to such an outcome in the medium term. As described in detail in Hantzsche et al. (2018), we consider the impact on bilateral trade and UK productivity, and through cross-country linkages in NiGEM the implications on international trade and relative prices. Our updated estimates also account for a potential diversion of FDI to other European countries using current shares in total EU27 inward FDI, similar to Bergin et al. (2019), as well as a diversion of UK net migration to alternative destinations depending on destination countries’ population size. We have not considered any productivity effects on other countries.

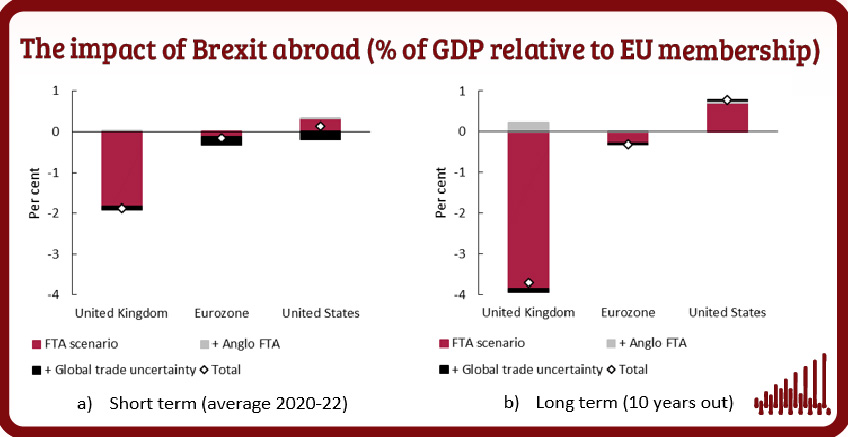

Figure 2b illustrates that in the long term, we would expect euro area GDP to be lower by 0.3 per cent in the FTA scenario relative to continued EU membership of the UK, in line with the evidence cited above. The impact on UK GDP is -3.9 per cent. As a result of the change in relative prices and trade diversion, there is a possibility that other countries may benefit from Brexit. Considering only the trade channel, we estimate that US GDP could be higher by up to 0.7 per cent (red bars).

Figure 2. The impact of Brexit abroad (% of GDP relative to EU membership)

Source: NIESR, NiGEM simulation.

Note: FTA scenario.

A sometimes-stated rationale for exiting the EU single market and customs union is to be able to negotiate bilateral agreements with other countries more flexibly. Using estimates for the impact of FTAs on bilateral trade between the UK and Anglosphere countries (US, Canada, Australia and New Zealand) provided by Ebell (2017), we calculate the additional impact on GDP (grey bars). For the UK, the economic benefit of such agreements amounts to around 0.2 per cent of GDP, only marginally counteracting the negative impact of leaving the EU. The direct impact on countries like the US is much smaller than the indirect effect of Brexit on global trade flows and international prices (0.1 per cent of GDP), given that goods trade is already fairly liberalised and conventional FTAs contain only few provisions on services trade.

Figure 2 also shows that any positive effects of Brexit abroad may materialise very gradually over time. In the short term (figure 2a), they may be offset by global trade uncertainty to which Brexit may contribute, here illustratively modelled as in increase in international investment risk premia as in Kara et al. (2019). Our analysis may also underestimate the global impact of disruptions to supply chains that rely on production processes in the UK.

Aggregate estimates presented here average over the impact of Brexit on individual sectors and households within countries which we would expect to vary substantially, creating winners and losers. Our modelling approach is also not capable of capturing the impact Brexit may have on how the political and economic system operates in the future (Hantzsche 2019), for instance by eroding confidence in regional economic integration. But what seems clear is that Brexit will be more damaging to the UK economy than on Europe or elsewhere, contrary to some perceptions.