Why we stand by our assessment of a £70bn Brexit impact

Given the febrile nature of the debate over Brexit in the run-up to one of the most contentious general elections in recent memory, it is hardly surprising that NIESR’s well received and widely-accepted analysis of the impact on the UK economy and people’s livelihoods of leaving the European Union has been criticised in some quarters.

Post Date

Post Date

Reading Time

Reading Time

Given the febrile nature of the debate over Brexit in the run-up to one of the most contentious general elections in recent memory, it is hardly surprising that NIESR’s well received and widely-accepted analysis of the impact on the UK economy and people’s livelihoods of leaving the European Union has been criticised in some quarters.

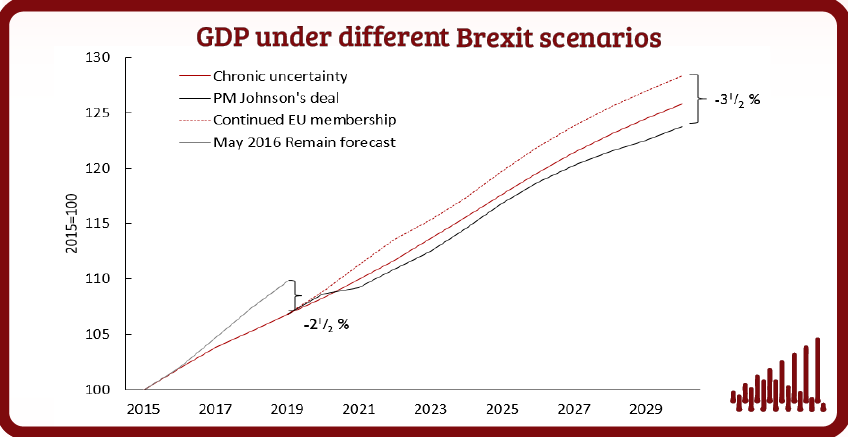

Our assessment is that the latest deal negotiated with the EU would reduce output per head in the United Kingdom by around 3-4 per cent, once the economy has adjusted to the new arrangements, compared with what it would have been if the UK had remained in the EU. That works out at £70 billion or about £1,000 per year per person for ever.

We are not saying that output would fall because of the Brexit deal, only that it would not grow by as much as it would otherwise have done. Nevertheless, there is no doubt that the headline number is very eye-catching and has been called into question by some who have claimed that NIESR is in some way biased or misguided in its approach.

Their accusations have centred on four key claims, none of which has any substance. The first is that we are biased because at some point we have received some funding from an EU body. That is wrong: we are funded mainly from research projects awarded by a variety of sources, which we publicly acknowledged in full. The terms of our grants prohibit any involvement from funding bodies in determining or influencing content. Whoever provides funding for our research whether into LGB&T rights or Brexit has no influence over the findings.

A second line of attack is to criticise our forecasting track record. Forecasting is an uncertain business and we have been upfront in providing post mortems of our forecasting record. Indeed, our latest quarterly economic forecast included an analysis that showed that NIESR’s forecasts for growth in 2016 and 2017 made before the referendum were close to the outturn and more accurate than those by HM Treasury, the OECD and the IMF.

A third critique is to say that no one can forecast accurately what will happen 10 years ahead. Like all forecasters, we produce predictions for growth and inflation with clear explanations of the risks surrounding those. These help us assess the effects of changes in policy and general direction of travel for the economy. Suppose you are setting out on a car journey from London to Manchester. It is difficult to be sure exactly how long the journey will take but you can be fairly certain that it will be quicker in the middle of a Sunday night than on a Friday evening when the roads are typically congested. In the same way, we can be reasonably sure that leaving the EU will make it more costly to trade with a large, open market on our doorstep and that this will have a negative effect on trade with the EU, productivity and living standards in the UK.

Finally, critics say NIESR’s analysis fails to take any account of the positive effect of free trade deals that Britain will be able to negotiate with other countries after Brexit. In fact, our most recent analysis does exactly that. It concludes, however, these are unlikely to have a very beneficial effect because they would be with countries that are further away than our EU partners which will add to the costs of trade and transport. There are also no examples of free trade deals outside of the EU that facilitate services trade, which makes up 80% of the UK economy, as much as the European single market.

Lack of official estimates

It is important to remember that one reason why our forecasts have caused such a furious debate is the total lack of any government estimates about the impact of the Prime Minister’s deal. The Chancellor has declined to update the government’s analysis. Despite this he has asserted that it is “self-evidently in our economic interest”.

The government’s own financial watchdog, the Office of Budget Responsibility, had been expected to publish its biannual economic forecasts this month alongside the Budget. However, after the Budget was cancelled, and the Cabinet Office ruled that their publication would breach the government’s general election guidance.

It is this gap that NIESR, which has no institutional position on how or whether the UK should exit the EU, has sought to fill by producing its own independent analysis of the likely impact of Brexit and its forecasts for the outlook for the UK and the world economy. The need for such unbiased assessments will become even more acute as the election campaigns get underway and the main political parties publish their own spending plans and their assessments of their rivals’ proposals.

Brexit is an experiment as no country has ever exited such a closely integrated trading area as the European Union. It will take several years after it has been implemented to gauge its effects. Until then, the best that can be done is to apply sound economic analysis such as we have tried to do, setting out our assumptions as transparently as possible so that others can judge the reasonableness of our conclusions.

We believe the evidence is overwhelmingly strong that Brexit will damage living standards in the UK, although the precise size of the effect is, for now, uncertain. We stand by those assessments and encourage the government to publish its own forecasts.

You can read the full analysis of the PM’s proposed Brexit Deal here.