UK Households Should Start Feeling Better Off as Election Looms

UK GDP growth will likely remain sluggish into the medium term. We now think the United Kingdom was in recession in the second half of 2023 and that GDP grew by only 0.3 per cent in 2023. We expect GDP to grow by 0.9 per cent in 2024 and at a similar rate throughout the rest of the forecast.

Pub. Date

Pub. Date

07 February, 2024

Pub. Type

Pub. Type

Main Points

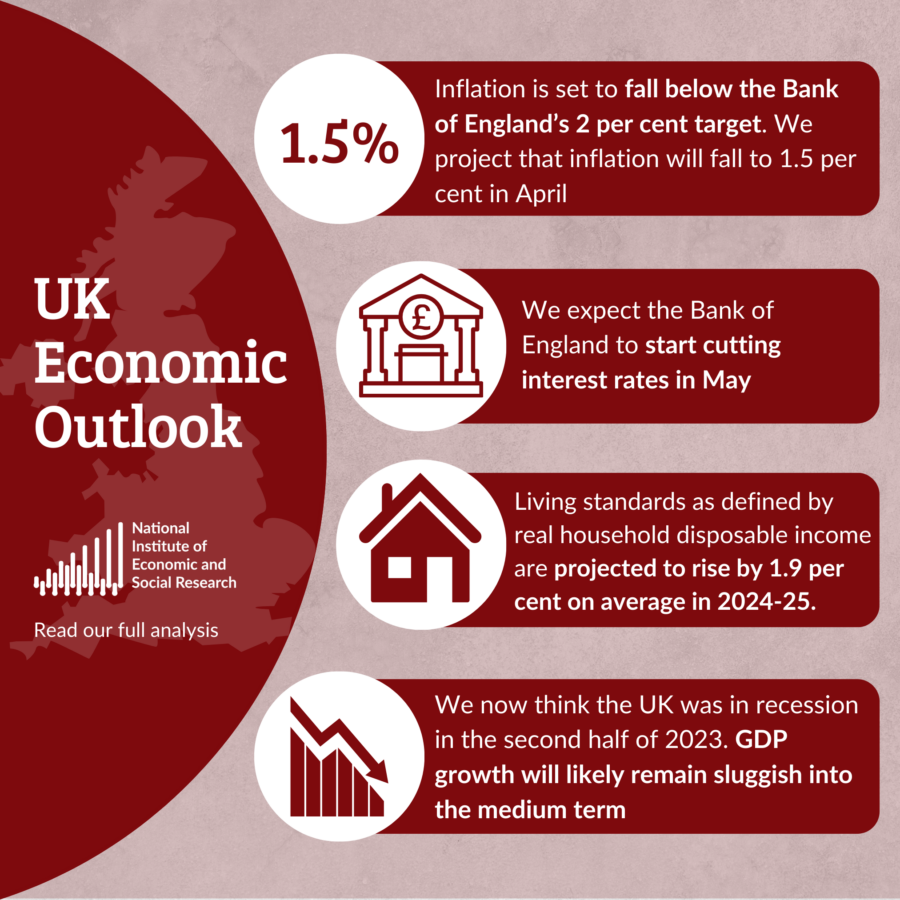

- UK GDP growth will likely remain sluggish into the medium term. We now think the United Kingdom was in recession in the second half of 2023 and that GDP grew by only 0.3 per cent in 2023. We expect GDP to grow by 0.9 per cent in 2024 and at a similar rate throughout the rest of the forecast.

- Inflation is set to fall below the Bank of England’s 2 per cent target in April. We project that inflation will fall to 1.5 per cent in April as Ofgem reduce the energy price cap by 14 per cent and the high inflation in early 2023 ‘drops out’ of the headline measure.

- We expect the Bank of England to start cutting interest rates in May. However, we expect further cuts to happen more slowly than is currently implied by market expectations given persistent core inflation, elevated wage growth and geopolitical challenges.

- On current plans the government meets its fiscal targets. But, it is simply not credible that the next government – whichever party may form it – will feel itself bound to the large fiscal tightening planned for 2025 and beyond. NIESR continues to stress the need to increase public investment, rather than put in place tax cuts that will have to be reversed in the not-too-distant future.

- The main risks to our forecast are geopolitical. Shipping costs between China and Europe have risen by around 150 per cent since the beginning of October. An escalation of the conflict in Gaza could lead both shipping costs and oil prices to rise further, pushing down on GDP and up on inflation.

- Living standards as defined by real household disposable income are projected to rise by 1.9 per cent on average in 2024-25 across all income deciles but will be below pre-pandemic levels: for households in income deciles 1-4, living standards will be between 7 and 20 per cent lower in 2024-25 compared with 2019-20.

- For the poorest 10 per cent, the fall in real income since 2019-20 is about £4,500 (in current prices): their living standards are lower by some 18 per cent compared with the pre-pandemic levels.

- Recent strong wage growth has reduced the gap between the top income percentile and the bottom income percentile: this is especially apparent in the North East where the bottom percentile has experienced the greatest year-on-year growth in average earnings of 17.1 per cent in 2022-23 compared to the UK average of 8.5 per cent growth (relative to 2021-22).

- Urgent action is required to help Local Authorities in distress and regenerate the regions: support local government finances, by plugging the funding gap of £4 billion including a reform of council tax, and a credible commitment to maintain public investment at 4 per cent of GDP per year and productivity beyond the next general election.

See our previous UK Economic Outlooks to follow the analysis