Inflation: Down, But Not Out

Smaller than expected fall in inflation to 3.4 per cent, but inflationary pressures remain across most sectors.

Annual CPI Inflation was 3.4 per cent in February 2024, down from 4.0 per cent in January 2024. This was largely driven by the high monthly figure from February 2023 of 1.1 per cent dropping out and the new inflation for February 2024 coming in at the high level of 0.6 per cent on the month, yielding the overall fall of 0.6 percentage points in the headline figure. The month-on-month rate of 0.6 per cent was the highest since May 2023 and if sustained for 12 months would lead to an annual figure of over 7 per cent. However, this may be a one-off being partly a rebound from the big sales effect in January. Measures of underlying inflation are a better guide to the longer-term outlook, and these are falling now: annual CPI inflation in services is down to 6.1 per cent from 6.5 per cent in the previous month; core CPI (excluding Food and Energy) inflation down to 4.5 per cent from the previous month’s 5.1 per cent. NIESR’s trimmed mean measure of core inflation is also down to 3.9 per cent from 4.9 per cent in January.

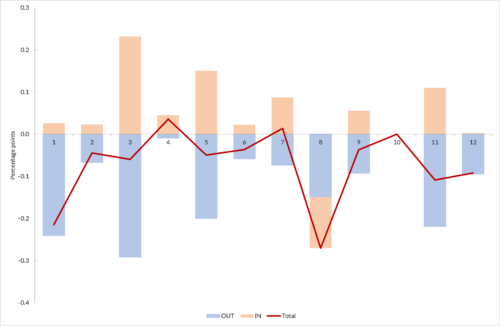

The fall in inflation is consistent across most sectors, the only positive contributions being small ones from Housing and Household Services and Transport. The other 10 sectors all had negative contributions. The main impacts came from:

Food and Non-alcoholic beverages -0.23 percentage points

Restaurants and Hotels -0.13 percentage points

Miscellaneous Goods and Services -0.07 percentage points

We can look in more detail at the contributions of the different sectors to overall inflation in Figure 2, with the old inflation dropping out of the annual figure (January-February 2023) shown in blue and the new monthly inflation dropping in (January-February 2024) shown in brown, using the new January 2024 expenditure weights to calculate CPI. The overall effect is the sum of the two and is shown as the burgundy line.

We can see our old story of the Blue team pulling inflation down across almost all sectors as last year’s high figures drop out, whilst the Brown is positive in nearly all sectors (Transport being the exception). So, the high overall month on month figure of 0.6 per cent is coming from all sectors, with big contributions in Clothing and Footwear along with Furniture and Household Equipment. Even Food and Non-Alcoholic Beverages comes in positive as part of the Brown team, despite the overall negative effect due to the big Blue drop out.

Extreme Items

Out of over 700 types of goods and services sampled by the ONS, there is a great diversity in how their prices behave. Each month some go up, and some go down. Looking at the extremes for this month, the top ten items with the highest monthly inflation are:

| Table 1: Top ten items for month-on-month inflation (%), Feb 2024 | |

| SPORTS BRA / CROP TOP | 139.93 |

| SRVYRS FEES MORTGAGE VALUATION | 46.21 |

| EURO TUNNEL FARES | 30.67 |

| KEROSENE – 1000L DELIVERED | 27.31 |

| EBOOKS | 26.51 |

| VACUUM CLEANER | 20.39 |

| LIGHT BULB | 18.52 |

| ULTRA LOW SULPHUR DIESEL RPI | 18.46 |

| ULTRA LOW SULPHUR DIESEL CPI | 18.40 |

| DRY SPAGHETTI OR PASTA 500G | 18.23 |

February was not a good month for those who red e-books whilst travelling to Paris on the trains.

The ten items with the highest negative inflation this month are shown in Table 2.

| Table 2: Bottom ten items for mom inflation (%), Feb 2024 | |

| MENS OFFICIAL FOOTBALL SHIRT | -22.78 |

| DWELLING INSURANCE | -24.75 |

| OLIVE OIL – 500ML – 1 LITRE | -25.39 |

| MORTGAGE INTEREST PAYMENTS | -27.21 |

| BOYS T-SHIRT 3-13 YEARS | -27.71 |

| COMPUTER SOFTWARE | -27.93 |

| MOBILE PHONE APPLICATIONS | -29.25 |

| CAR INSURANCE | -31.05 |

| CD ALBUM (TOP 40) | -34.52 |

| ROADSIDE RECOVERY SERVICE | -37.37 |

January was a great month for getting some new CDs if you can find where you put that old CD player….

In both these tables we look at how much the item price-index for this month has increased since the previous month, expressed as a percentage. These calculations were made by my former PhD student at Cardiff University, Dr Yang Li, who has since returned to Shanghai.

Looking Ahead

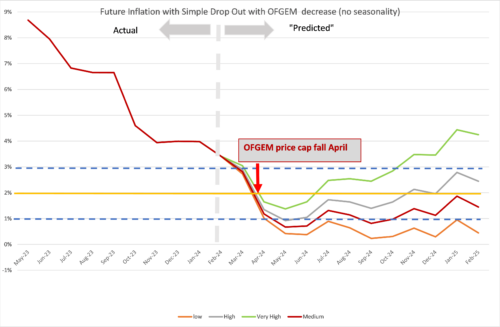

We can look ahead over the next 12 months to see how inflation might evolve as the recent inflation “drops out” as we move forward month by month. Each month, the new inflation enters the annual figure and the old inflation from the same month in the previous year “drops out”.[1] Previously we ended the “low inflation” scenario but have reintroduced it in response to some recent months with near zero month-on-month inflation. We have also dropped the “High inflation persistence” scenario as it now looks unlikely unless geopolitical factors deteriorate significantly. We depict the following scenarios for future inflation dropping in:

- The “medium” scenario assumes that the new inflation each month is equivalent to what would give us 2 per cent per annum or 0.17 per cent per calendar month (pcm) – which is both the Bank of England’s target and the long-run average for the last 25 years.

- The “high” scenario assumes that the new inflation each month is equivalent to 3 per cent per annum (0.25 per cent pcm). This is now the central forecast.

- The “very high” scenario assumes that the new inflation each month is equivalent to 5 per cent per annum (0.4 per cent pcm). This reflects the inflationary experience of the United Kingdom in 1988-1992 (when mean monthly inflation was 0.45 per cent).

- The “low” scenario assumes inflation each month is equivalent to 1 per cent per annum (0.08 per cent pcm).

Inflation has been even noisier than usual in recent months. In October and November 2023 month-on-month inflation was zero, and then quite high at 0.4 per cent in December. January 2024 was large and negative as in the previous year. However, in 2023 we saw a “bounce back” of inflation with monthly inflation higher than normal in February 2023 at 1.1 per cent. This has occurred again this February, albeit with a smaller bounce back of 0.6 per cent. This makes it hard to pick which scenario is most likely. Previously we have followed the “very high” or “high” scenarios. We still think that the new figures are likely to come in on average somewhere between the two in the coming months. However, there is a special factor: in April there is going to be a fall in the OFGEM price cap resulting in a downward push of 0.6 percentage points (plus the drop out of the April 2023 increase in the price-cap). Overall, there will be a blue “drop out” reducing inflation by 1.2 per cent and the new OFGEM drop in of -0.6 per cent, so these two factors will lead to an overall fall in the headline inflation of 1.8 per cent less the “new inflation” in the various scenarios. In all scenarios, we see the high inflation from the first two quarters of 2023 dropping out and this will drag CPI inflation down until May 2024.

The latest ONS data (covering the three months to January 2024) suggest that wages are growing at 6.1 per cent (excluding bonuses). That is, wage growth remains high as wages continue to catch up with past inflation. We can expect this to continue and put upward pressure on prices, particularly in the service sector. The inflation rate in services remains at high 6.1 per cent but is falling, whilst core inflation (excluding food and energy) has dropped significantly to 4.5 per cent. These factors indicate that inflationary pressures are likely to persist well into 2024. However, the dropping out of the high inflation rates from 2023 will tend to dominate and drive down headline inflation for the first half of 2024 despite these persistent inflationary pressures.

Whilst the fall in inflation this month is slightly less than expected the dip in inflation is still likely to be significant with inflation falling to 1.4 per cent in the “very high” scenario and 1 per cent in the “high” scenario. In the less likely medium and low scenarios inflation comes out at around 0.4 – 0.7 per cent in May. The extent of the increase in inflation after May will be less driven by the effect of old inflation from 2023 dropping out and more influenced by the new inflation emerging, which is why our scenarios show very different end points by February 2025, ranging from 1 per cent to over 4 per cent. We could say that inflation may be down by May 2024, but it will not be out.

This forecast assumes that geopolitical tensions do not deteriorate. Direct conflict between Russia and NATO would rapidly worsen the picture for inflation. Looking east, if the rising tensions between the United States and China lead to an intensification of the trade war or even open military conflict in the South China Sea or Republic of China (Taiwan), world supply chains would be disrupted, and inflation significantly raised, to levels far higher than seen in 2022.

The current conflict in the middle east seems to be spreading beyond Israel and Gaza. Already the Houthi’s have disrupted trade through the Red Sea and Suez Canal. If Iran becomes involved and the straits of Hormuz are also blocked, then this will have a major effect on the supply of goods and particularly oil and liquified natural gas (LNG) which could significantly increase inflation. Also, the United States has recently indicated that its LNG exports might be restricted in the coming months, which may also lead to higher prices paid in Europe.

For further analysis of current and future prospects for inflation in the UK see:

- NIESR CPI Tracker

- When will UK inflation return to the Bank of England’s target of 2 per cent a year? Economics Observatory.

- How does Inflation affect the economy when interest rates are near zero? Economics Observatory.

- How are rising energy prices affecting the UK economy? Economic Observatory.

- NIESR Economic Outlook

[1] This analysis makes the approximation that the annual inflation rate equals the sum of the twelve month-on-month inflation rates. This approximation ignores “compounding” and is only valid when the inflation rates are low. In future releases I will add on the compounding effect to be more precise at the current high levels of inflation.