What pension funds need to know about global economic outlook

Over the past year, the world has become a more dangerous place. There looks to be no end in sight to the Russia-Ukraine conflict, while in the Middle East, Israel continues its campaign against Hamas, Houthi rebels in Yemen continue to disrupt shipping through the Red Sea, and tensions continue to build between the United States and Iran.

But despite all this, financial market uncertainty – as measured by the Chicago Board of Exchange Market Volatility Index (VIX) – remains low. The VIX increased in September, and more so in October in response to the Hamas attacks on Israel and the initial response of Israel in Gaza. But then the index fell back in November and remains at a level below its average over the 2010s.

Against this background, global growth remains slow: NIESR expects global growth of only 3.1% in 2023, 2.8% in 2024 and 3% in 2025.

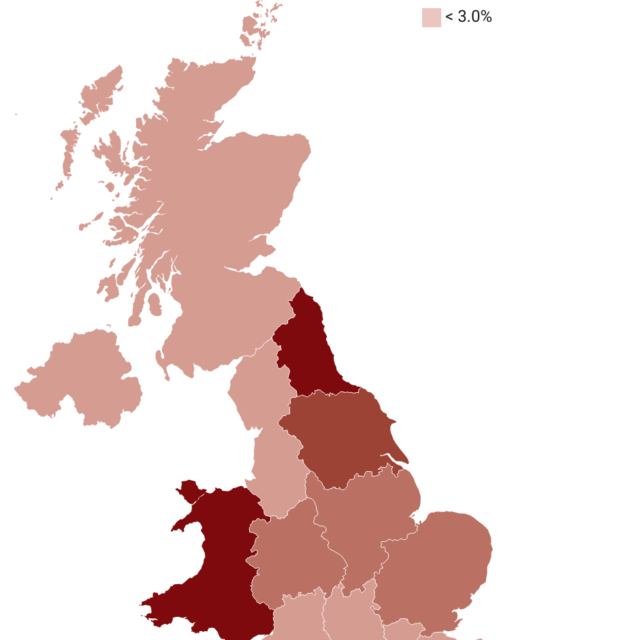

The Euro area is stagnating, with almost zero growth for three consecutive quarters, and Germany, its largest economy, experienced a contraction in GDP last year. We now think the United Kingdom was also in recession in the second half of 2023. Looking forward, we think sluggish global GDP growth is indicative of a ‘new normal’: China and India have, to a large degree, caught up with the global technological frontier and are likely to grow more slowly moving forward, and we have probably now seen all the productivity gains from globalisation.

Shipping cost concerns

But there is a risk that global growth will be even slower in the near future. So far, the events in Israel and Gaza – while representing a grave humanitarian crisis – have not spilled over into global economic growth. That said, Houthi attacks on shipping in the Red Sea have raised shipping costs as almost all companies have diverted their container ships around the Cape of Good Hope.

The Shanghai Containerised Freight Index, for example, has increased by around 150% since the end of September, though other measures of shipping costs have not risen as much. With 27% of UK oil imports passing through the Gulf of Aden, the effect on UK import prices, and so inflation, could well be significant. If the conflict in the Middle East were to escalate further, we could see a serious disruption in oil supply and much higher oil prices, with consequences for global growth and inflation.

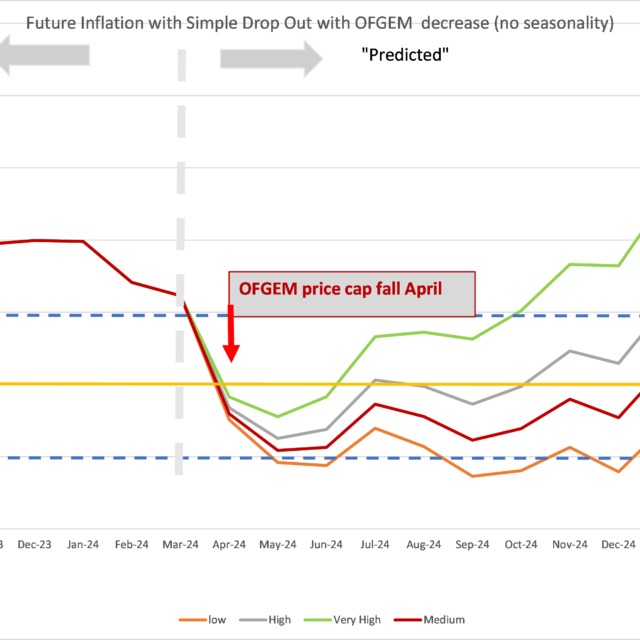

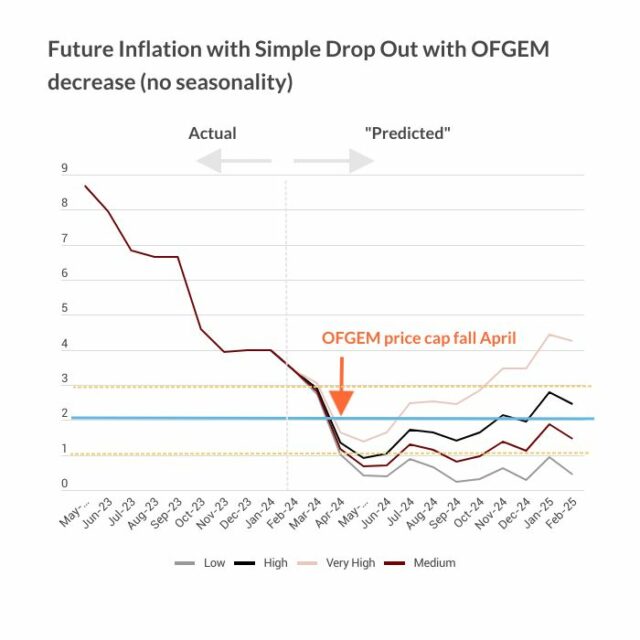

It now looks like the central banks have done their jobs, as inflation is falling in the advanced economies, though rates are not yet quite at target. That said, the fall in inflation has been driven by lower food and energy price inflation while underlying, or core, inflation remains an issue.

NIESR expects OECD inflation to fall to 7.1% in 2024 and 3.8 per cent in 2025 as lower oil and commodity prices combined with sluggish economic activity act to push down on both headline and core inflation, although geopolitical events remain a risk to this outlook.

Year of elections

With inflation rates coming down towards target, we think interest rates have now peaked, though central banks will need to be convinced that core inflation has come down before they start reducing rates. NIESR’s forecast is for cuts in policy rates to begin in the middle of 2024 and rates to have fallen by between 75 and 100 basis points by the end of the year.

With short rates now expected to fall later this year, financial markets have picked up with equity prices rising by around 18%, 15% and 5% in the United States, Euro Area and United Kingdom, respectively, since the end of October. At the same time, 10-year bond yields fell by around 75 and 45 basis points in the United States and Europe, respectively. We expect a continuation of these trends in 2024.

2024 will be a year of elections with over half the world’s population voting. While some elections may have limited effects outside their own countries, others may have significant implications for the rest of the world.

In particular, this year’s US presidential election may have large ramifications for the global economy. Should Trump win, we would likely see large tax cuts, putting pressure on the US fiscal position and raising inflation, while the Federal Reserve would likely face increased political pressure to maintain a loose monetary policy. An increase in tariffs would likely disrupt supply chains while having a significant effect on the welfare of US households.

Finally, it is possible that a Trump win would lead the United States to disengage from the global economy with negative effects on global output and welfare: an outcome no one would like to see!