1.2 million UK Households Insolvent This Year as a Direct Result of Higher Mortgage Repayments

UK households are about to be hit by yet another shock as a result of the Bank Rate rising to 5 per cent, and by the end of 2023 more than a million households (4 per cent of all UK households) will run out of savings because of higher mortgage repayments, taking the total proportion of insolvent households to nearly 30 per cent (around 7.8 million), according to the latest research by the National Institute of Economic and Social Research (NIESR).

With the Bank Rate rising at their fastest pace since the Bank of England gained independence in 1997, millions of households will be affected by higher mortgage repayments.

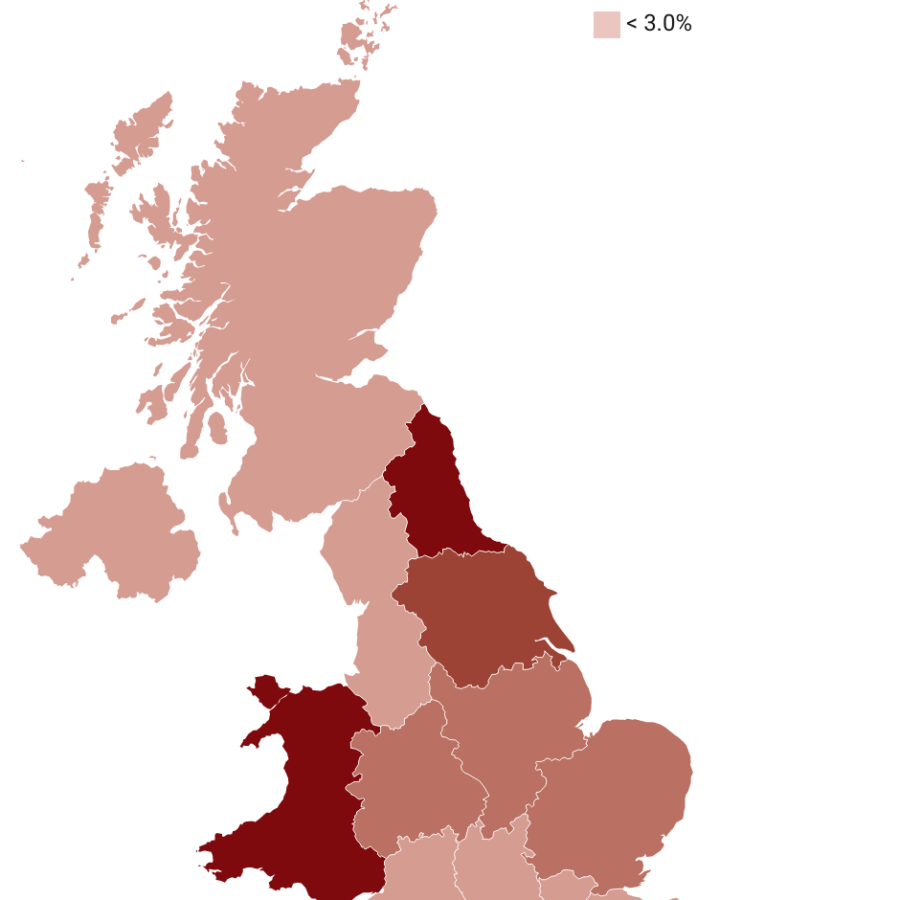

A significant proportion of the population will see their savings wiped out because of the rise in interest rates and thus higher mortgage repayments. The largest impact will be felt in Wales and the North-East where up to 6 per cent of households are projected to be insolvent by the end of the year as a direct result of rising mortgage repayments.

Also, the analysis finds that the rising repayments in aggregate will wipe out 0.3 per cent of UK GDP, costing all households with mortgages a total of £12bn per year.

Other key points include:

- Monthly mortgage repayments will rise by nearly 50 per cent on average: this rise is above typical stress-tests households are subjected to when applying for a mortgage.

- Fixed-rate monthly mortgage repayments will rise from around £700 to £1,000 on average: this applies to nearly 2m households when needing to remortgage.

- Variable-rate monthly mortgage repayments will rise from around £450 to £700: this applies to 1.5m households on variable-rate mortgages.

Given the findings above, we would recommend the government to consider intervening in forbearance agreements, which allow households to agree to create repayment plans based on what they can afford when they are unable to repay their debt.

Max Mosley, NIESR Economist, said: “The rise in interest rates to 5% will push millions of households with mortgages towards the brink of insolvency. No lender would expect a household to withstand a shock of this magnitude, so the government shouldn’t either. Some investment should be done in forbearance agreements, giving households and lenders the ability to create payment plans that work for each other.”

The full analysis can be downloaded on this page from the right hand side button.