NIESR’s Response to Ofgem Energy Price Cap Announcement

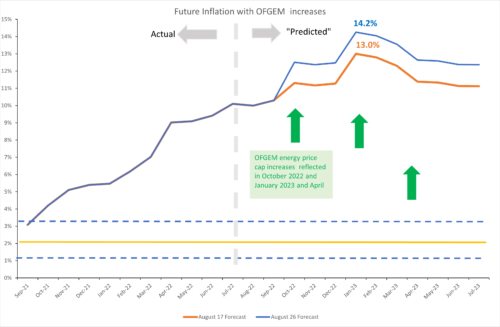

“Today Ofgem announced a rise in the energy price cap of 80%. This will raise the cost of a standard variable dual-fuel tariff from £1,971 to £3549 for the average household. In turn, this will add 2.7 percentage points to the CPI inflation rate in October, taking our forecast for CPI inflation in October from 11.3% to 12.5%. We expect the overall contribution of gas and electricity prices to CPI inflation in October to be 5.9 percentage points.

But this increase does not signal the end of energy price rises. We expect the energy price cap to rise further in January (by 31% to £4649). And that would imply a forecast for CPI inflation of 14.2% in January. This compares with the recent prediction of Citi that CPI inflation will peak at over 18% in January.

One implication of this rise in expected inflation is that the Monetary Policy Committee will now need to tighten monetary policy faster and by more than we had previously thought. We now expect the policy rate to rise to 4.25% by May of next year.”

Prof Stephen Millard, Deputy Director for Macroeconomic Modelling and Forecasting

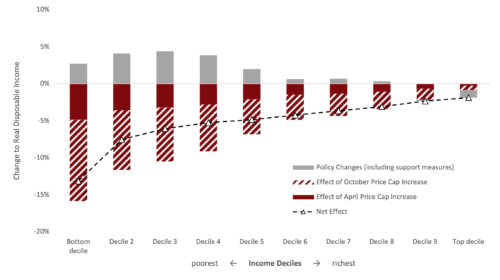

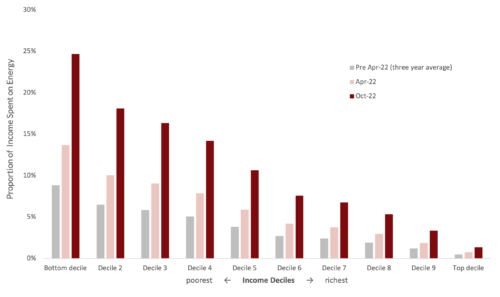

“This increase in the cost of energy, coupled with the rising prices of food and other necessities, will hit the poor and low-income households hardest. The previous increase in the energy price cap reduced the real disposable incomes of the poorest households by 5 per cent. Today’s announced cap will reduce this a further 11 per cent, which means that they will be 16 per cent poorer than they were last year solely as a result of the increase in energy prices. The poorest households will now be spending 25 per cent of their income just on energy bills. Around 2.2 million (8 per cent) additional households will run out savings by April 2024, bringing the total to around 6 million (22 per cent), nearly one in four.

Policy support has so far failed to keep up with the magnitude of the cost-of-living crisis. Our calculations find that the package of support measures announced in the March Spring Statement, together with the additional help introduced on 26 May, falls well short of the combined effect of rising price caps. The total increase in domestic energy bills is 7 times the size of the support measures.

To stop a further slide into poverty and destitution, we favour extra targeted assistance rather than a general subsidy for all, which would benefit top-earners who can more easily cushion the price shock. Therefore, we call for a temporary uplift of Universal Credit of £50 per week alongside an increase in the energy grant from £400 to £800 for the 11 million households that struggle to make ends meet. Implementing these measures for the period from September 2022 to March 2023 would cost the Exchequer approximately £7bn and provide some relief for the autumn and winter months.”

Prof Adrian Pabst, Deputy Director for Public Policy

Changes to Real Disposable Income Following Price Cap Changes

Notes: Policy changes include the net changes to National Insurance Contributions (the increase in the threshold minus the increase in its contribution rate) plus the support measures announced in the Spring Statement and in May.

Source: LINDA

Source: LINDA