Household Behaviour Under Rationing

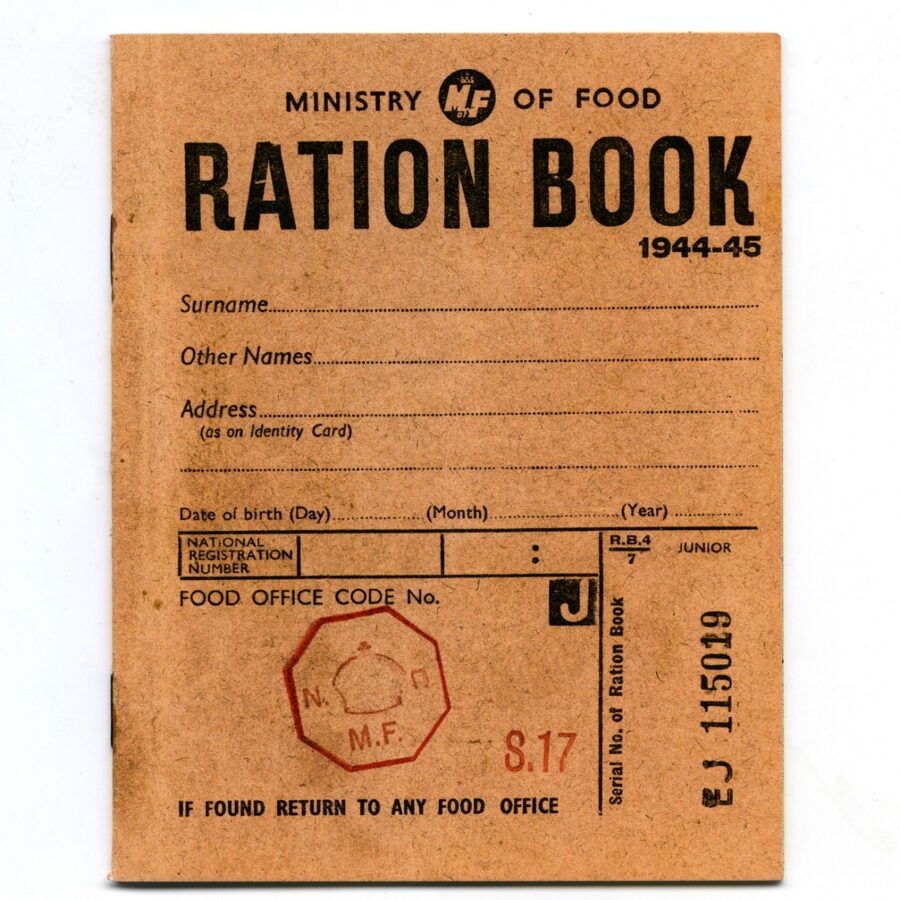

The pandemic-induced economic crisis has seen a massive increase in savings as households could not spend their income. The last time that consumers were seriously rationed was during the Second World War. This article models the behaviour of households during the War years and its immediate aftermath in Ireland, Sweden, the US and UK. Households did not spend all of the savings after the War, with some of them going to finance housing investment.

Pub. Date

Pub. Date

20 November, 2023

Pub. Type

Pub. Type

Main Points

- The Second World War saw a substantial build-up in personal savings in Sweden, Ireland, the UK and the US. The rise in the savings rate occurred partly because of war-induced fears about the future, but also because consumers could not purchase many of the goods they desired due to rationing or scarcity.

- As a consequence of the rise in the savings rate, there was a dramatic fall in the volume of consumption during the war years in the four countries considered here (Sweden, Ireland, the UK and the US). This fall occurred despite the fact that real incomes were unchanged or were even higher in 1945 than at the start of the War in 1939.

- When the War ended and rationing was gradually phased out, households returned to spending the majority of their incomes. A larger component of the excess savings was channelled into the housing market. The result was a rapid rise in real house prices between 1945 and 1948 in all four countries.

- It remains to be seen whether the rebound in consumption in 2022 and 2023 mirrors the post-War experience. Even with the return to a ‘normal’ savings rate, there is a big rise in the volume of consumption.

- If households behaved as they did during the post-War years, a small amount of the excess savings may be used to further expand consumption, and some may finance increased demand for housing. However, the Ukraine war and the rise in inflation could lead to a new bout of precautionary saving.