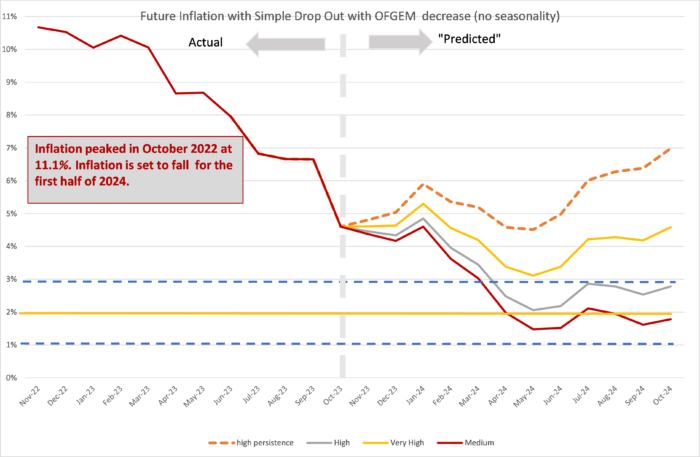

Record Breaking Fall in Inflation to 4.7% in October, With Inflation Set to Fall to 2-3% by May 2024

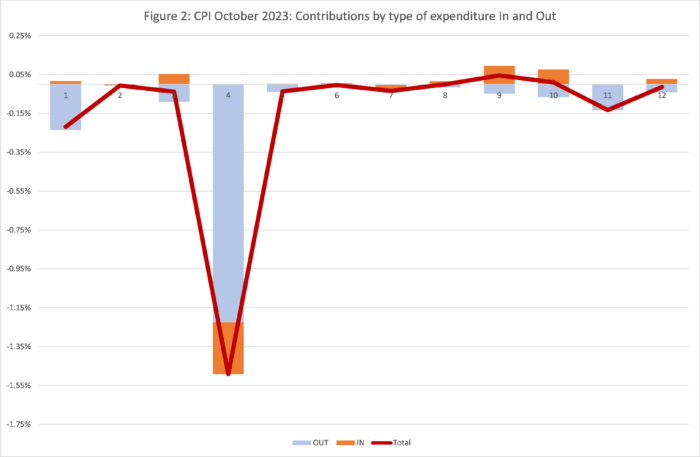

CPI Inflation was 4.6 per cent in October, down dramatically from 6.7 per cent in September. Month on month inflation for September-October 2023 came in at 0.0 per cent, whilst the old inflation from September-October 2022 of 2.0 per cent dropped out, giving an overall fall of 2.1 per cent after rounding. Even though new inflation in September-October 2023 was zero overall, Inflationary pressures remain spread across most sectors, with negative inflation in only 3 (particularly the domestic energy component of Housing, water and energy).

| Housing, Water and Energy | -1.55 percentage points |

| Food and Non-Alcoholic Beverages | -0.24 percentage points |

| Restaurants and Hotels | -0.13 percentage points |

We can look in more detail at the contributions of the different sectors to overall inflation in Figure 2, with the old inflation dropping out of the annual figure (September-October 2022) shown in blue and the new monthly inflation dropping in (September-October 2023) shown in Brown, using the expenditure weights to calculate CPI. The overall effect is the sum of the two and is shown as the burgundy line.

The dominant effect is from Housing, water and energy, where both the drop-out and drop-in reinforce each other to give a very large effect on the headline rate. Both the drop-out and drop-in are largely driven by the OFGEM price cap changes in October 2022 and 2023. Energy Prices have fallen considerably since 2022 but remain significantly higher than in 2020. In other sectors, we see that the blue drop-outs are all negative, whilst the brown drop-ins are mostly positive but small, giving rise to a net effect close to zero except for the three sectors highlighted above. The most interesting sector is perhaps Hotels and restaurants for which there was a zero drop-in and so the whole contribution was due to the drop-out from September-October 2022. Similarly, for Food the negative effect this month is due to the large drop-out combined with a small drop-in. If we look at Goods versus Services, we see that the annual rate for services inflation is 6.9 per cent whilst for goods inflation it is just 2.9 per cent, with the 1-month rates being -0.3 and 0.4 per cent respectively. This indicates that inflationary pressures are still strong in the services sector (reflecting rising wages and labour costs), as is core inflation (CPI excluding food and energy) which remains at an annual rate of 5.7 per cent and a 1-month rate of 0.3 per cent.

Looking Ahead

We can look ahead over the next 12 months to see how inflation might evolve as the recent inflation ‘drops out’ as we move forward month by month. Each month, the new inflation enters the annual figure and the old inflation from the same month in the previous year ‘drops out’.[1] Previously we ended the ‘Sanctions scenario’ introduced in March 2022 in response to the invasion of Ukraine by Russia. However, since the new month on month inflation became high again in Feb-May 2023, we have re-introduced the Sanctions scenario, but renamed it the ‘high persistence’ scenario since the causes have little to do with war and sanctions but rather domestic wage-price dynamics. We depict the following scenarios for future inflation dropping in:

- The ‘medium’ scenario assumes that the new inflation each month is equivalent to what would give us 2 per cent per annum or 0.17 per cent per calendar month (pcm) – which is both the Bank of England’s target and the long-run average for the last 25 years.

- The ‘high’ scenario assumes that the new inflation each month is equivalent to 3 per cent per annum (0.25 per cent pcm).

- The ‘very high’ scenario assumes that the new inflation each month is equivalent to 5 per cent per annum (0.4 per cent pcm). This reflects the inflationary experience of the United Kingdom in 1988-1992 (when mean monthly inflation was 0.45 per cent).

- The ‘high persistence’ scenario assumes new month on month inflation of 0.6 per cent, which is equivalent to an annual rate of 7.4 per cent.

Aristotle said ‘One swallow does not a summer make, nor one fine day’: the fact that 1-month inflation was zero in October does not mean that inflationary pressures have disappeared. Monthly inflation is a very noisy series. We still see high wage growth, with average earnings growing at 7.7 per cent per annum (excluding bonuses), as wages catch up with past inflation. We can expect this to continue to put upward pressure prices, particularly in the service sector. As we noted, 1-month inflation in the service sector remains high (0.3 per cent or an annualised rate of 4.3 per cent), whilst core inflation (excluding food and energy) remains at an annual rate of 5.7 per cent and a 1-month rate of 0.3 per cent.

Therefore, we are shifting our focus for our central scenario form the ‘very high’ to the ‘high’, although the future will probably lie between the two. The ‘high persistence’ is less likely now (geopolitics aside). If we track the ‘high’ scenario, we see inflation falling to 2 per cent by May 2024 (the fall is largely driven by the large drop-outs from early 2022), before rising to 3 per cent from July 2024 onwards. The ‘very high’ scenario sees inflation dropping to 3 per cent by May and then back up to 4 per cent from July onwards. Under both scenarios, we see inflation remaining high into late 2024. In order for inflation to drop to target and remain there, we would need to see 1-month inflation following the ‘medium’ scenario and coming in at 0.17 per cent (on average). We will just have to see how the figures come in over the coming months to guide us as to the best scenario to take forward.

[1] This analysis makes the approximation that the annual inflation rate equals the sum of the twelve month-on-month inflation rates. This approximation ignores ‘compounding’ and is only valid when the inflation rates are low. In future releases I will add on the compounding effect to be more precise at the current high levels of inflation.