Will UK Markets See Turbulence Once the Bank Rate Peaks?

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Main points

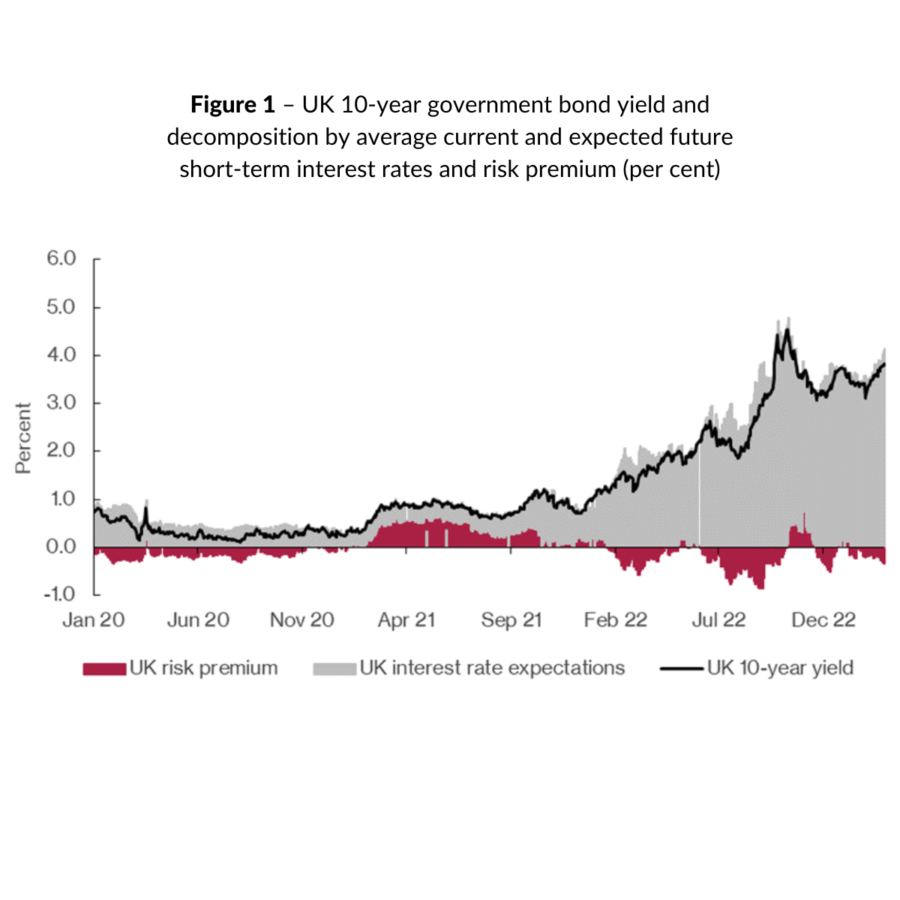

- The 10-year UK government bond (gilt) yield was on an upwards trend over the course of 2022 as a result of the Bank of England’s aggressive monetary policy tightening cycle. In the first quarter of 2023, the 10-year gilt yield has fluctuated around 3.6 per cent, driven by short-term interest rate expectations.

- Overall, the UK term premium signals that investors are feeling certain about the path of short-term interest rates. In our Winter UK Economic Outlook, we noted that while there is little uncertainty surrounding the current monetary tightening cycle, the questions of how long the MPC should maintain the Bank Rate at its peak level and, once there, the pace at which to loosen remain contested. If the MPC does not provide clear communication surrounding these issues, we may well see uncertainty return to markets once investors believe the Bank Rate has peaked.

- In February, policymakers at the Federal Reserve (Fed) opted for a policy rate hike of 25 basis points, while the MPC and European Central Bank hiked by 50 basis points. All three central banks hinted at further interest rate rises over the coming months given that inflationary pressures remain persistent.

- Despite the ECB broadly tightening monetary policy in concert with the Bank and the Fed, in contrast to those central banks it is facing an increasingly fragmented environment, resulting both from high inflation and term premia dispersion among Euro Area countries. In bond markets, Italy and Greece continue to decouple from trend, with our latest term premia estimates around 1.20 percentage points higher than the Euro Area average. While this pales in comparison to post-Financial Crisis fragmentation, it still presents an important risk to financial stability and the transmission of monetary policy in the Euro Area.

“ UK 10-year gilt yields have fluctuated around 3.6 per cent in the first months of 2023, driven by short-term interest rate expectations. With the exception of a short spell of a rising term premium from 22 December to 10 January, possibly brought on by the statistical release of the November 2022 public sector finances, UK investors seem broadly confident in the path of UK short-term interest rates. That said, the questions of how long the MPC should maintain the Bank Rate at its peak level and the pace at which to loosen remain contested. If the MPC does not provide clear communication surrounding these issues, we wonder if we will see uncertainty return to markets once investors believe the Bank Rate has peaked.”

Paula Bejarano Carbo, Associate Economist NIESR