Inflation Falls Less than Expected, with Inflationary Pressures Persisting

CPI fell to 10.1% in March from 10.4% in February. The new inflation coming in between February and March was higher than expected at 0.8%, but was outweighed by the even bigger drop out of 1.1% from the previous March, leading to the slight reduction in the headline of 0.3%.

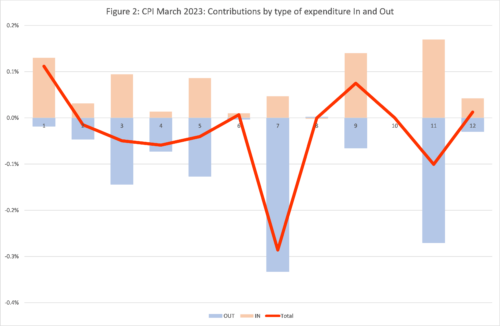

Month on month inflation was positive for 11 out of the 12 types of expenditure, indicating that inflation remains widespread. Combining the drop-ins with the drop-outs from Feb-March 2022, the sectors making the largest contribution to the change in the March 2023 headline inflation were:

- Transport -0.3 percentage points

- Food and non-Alcoholic Beverages 1 percentage points

- Housing and household services -0.09 percentage points

- Recreation and culture 08 percentage points

Month on month inflation was extremely high from March to May 2022, so, as we move forward into 2023, inflation will tend to fall as these big increases drop out. The tug of war between the new inflation dropping in and the old inflation dropping out will mostly see the old inflation winning and inflation falling.

As I argued in last month’s inflation blog, the inflation in December to January saw a big drop in prices so that the increase in January to February reflected a “bounce back” effect as prices recovered from the big discounts in January. I argued that if we combined the fall in prices in January with the increase in February, we were still below the trend at the end of 2022. For the two months October – December 2022 there was 0.8% inflation, whilst if we look over the two months December 2022 – February 2023 there was just 0.5%. Thus I argued that the large month on month figure of 1.1% was best seen as “bounce back” and did not indicate an intensification of inflationary pressures. However, I cautioned that “if inflation in March is also at a high level, then that would call for a revisiting of this judgement.” Well, the figure for month of March at 0.8% is significantly above the levels seen in the last quarter of 2022 and certainly seems to indicate that inflationary pressures are still very much present and will mean the fall in inflation in 2023 might be much slower than some had hoped for. We should learn in the next few months how persistent inflation is going to be.

We can look in more detail at the contributions of the different sectors to overall inflation in Figure 2, with the old inflation dropping out of the annual figure (Feb-March 2022) shown in blue and the new monthly inflation dropping in (Feb-March 2023) shown in Brown, using the expenditure weights to calculate CPI. The overall effect is the sum of the two and is shown as the burgundy line.

We can see that for most types of expenditure, there are big drop-outs from the previous year (the Blue team) but the drop-ins (the Brown team) are also large in many sectors. Overall, The Blue team has clearly won the tug of war this month, pushing inflation down 0.3 percentage points overall.

Extreme Items

Out of over 700 types of goods and services sampled by the ONS, there is a great diversity in how their prices behave. Each month some go up, and some go down. Looking at the extremes, for this month, the top ten items with the highest monthly inflation are:

| Table 1: Top ten items for month-on-month inflation (%), March 2023 | |

| SMART SPEAKER | 46.69 |

| CHARCOAL BBQ NOT DISPOSABLE | 20.22 |

| FRUIT/VEG SMOOTHIE | 16.69 |

| COMPUTER GAME 3 | 15.94 |

| COMPUTER GAME DOWNLOADS | 15.84 |

| TABLET COMPUTERS | 11.58 |

| SHOWER GEL 150-250ML | 10.36 |

| INTERNET BLU-RAY DISC | 9.84 |

| MEN’S T-SHIRT SHORT SLEEVED | 9.74 |

| HOTEL 1 NIGHT PRICE | 8.96 |

March was not a good month for an impromptu afternoon rave and BBQ.

The ten items with the highest negative inflation this month are shown in Table 2.

| Table 2: Bottom ten items for mom inflation (%), March 2023 | |

| CREAM LIQUER 70CL-1LT 14-20% | -5.99 |

| BODY M’RISING LOTION 200-400ML | -6.10 |

| KEROSENE – 1000L DELIVERED | -6.67 |

| WOMENS SHORT SLEEVE SPORTS TOP | -6.67 |

| SOUNDBAR | -6.75 |

| INTERNET COMPUTER GAMES | -7.59 |

| PRE-RECORDED DVD (FILM) | -8.13 |

| PREMIUM POTATO CRISPS/CHIPS | -8.46 |

| EBOOKS | -10.85 |

| ROADSIDE RECOVERY SERVICE | -19.01 |

If your car broke down, you could have got out the Bailey’s, waited for the recovery van whilst applying body lotion, possibly wearing your short sleeved sports top.

In both these tables we look at how much the item price-index for this month has increased since the previous month, expressed as a percentage. These calculations were made by my PhD student at Cardiff University, Yang Li. Congratulations to Yang for passing his PhD viva in March!

Looking Ahead: Ukraine and beyond

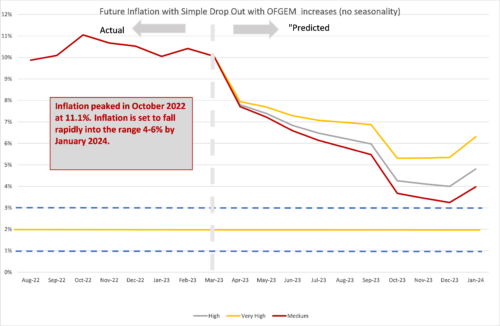

We can look ahead over the next 12 months to see how inflation might evolve as the recent inflation “drops out” as we move forward month by month. Each month, the new inflation enters the annual figure and the old inflation from the same month in the previous year “drops out”.[1] However, the invasion of Ukraine by Russia and the western sanctions in response continue to make things uncertain. That said, the world economy seems to have adapted to the dislocation caused as supply chains are re-routed and the effect seems to be abating and is not as bad as some had feared. We have therefore ended the “Sanctions scenario” introduced last March in response to the invasion. However, if we see the new month on month inflation remain high as it was in March, we may need to re-introduce the Sanctions scenario. We depict the following scenarios for future inflation dropping in:

- The “medium” scenario assumes that the new inflation each month is equivalent to what would give us 2% per annum – 0.17% per calendar month (pcm) – which is both the Bank of England’s target and the long-run average for the last 25 years. This is a reference point only, as inflation will be well above this level for the next year.

- The “high” scenario assumes that the new inflation each month is equivalent to 3% per annum (0.25% pcm).

- The “very high” scenario assumes that the new inflation each month is equivalent to 5% per annum (0.4% pcm). This reflects the inflationary experience of the UK in 1988-1992 (when mean inflation was 0.45%). It also reflects the continuation of the UK average in the second half of 2021. This level of month-on-month inflation would indicate a significant break from the historic behaviour of inflation from 1993-2020.

In recent months our central forecast was the “very high scenario”. However, as inflationary pressures fall, we will adjust our central forecast to the “high” and hopefully later on back to the historic “medium” scenario consistent with 2% annual inflation.

We have dropped the “low” scenario from previous releases as this is still likely to irrelevant for 2023. In all scenarios, there is a rapid fall in inflation from February 2023, which is due to the drop out of the high inflation figures in the corresponding months this year. However, inflation will remain well above 2% for the whole of 2023.

This forecast assumes that geopolitical tensions do not deteriorate. Direct conflict between Russia and NATO would rapidly worsen the picture for inflation. Looking east, if the rising tensions between the US and China lead to an intensification of the trade war or even open military conflict in the South China sea or Republic of China (Taiwan), world supply chains would be disrupted, and inflation significantly raised, possibly to levels far higher than seen in 2022.

However, the local elections in Taiwan in November 2022 resulted in very good results for the opposition KMT party. The President of Taiwan Tsai Ing-wen resigned from her position as leader of the Democratic Progressive Party after the elections. The KMT supports the “one China” policy and opposes the separatist independence policy, which might suggest that the “Taiwan issue” may calm down for some time (at least until the presidential election in January 2024). There may be a negotiated settlement to end the war in Ukraine later in 2023, which would stabilise the economic situation and lead to a further reduction in commodity and energy prices, especially if sanctions on Russia are eased as part of the settlement.

Figure 2: Looking forward to January 2024

For further analysis of current and future prospects for inflation in the UK see:

NIESR Spring Budget 2023: Who Will Benefit and Who is Left Behind?

How does Inflation affect the economy when interest rates are near zero? Economics Observatory.

How are rising energy prices affecting the UK economy? Economic Observatory.

[1] This analysis makes the approximation that the annual inflation rate equals the sum of the twelve month-on-month inflation rates. This approximation ignores “compounding” and is only valid when the inflation rates are low. In future releases I will add on the compounding effect to be more precise at the current high levels of inflation.