Low to Middle Income Households Facing Seven Years of Falling Living Standards

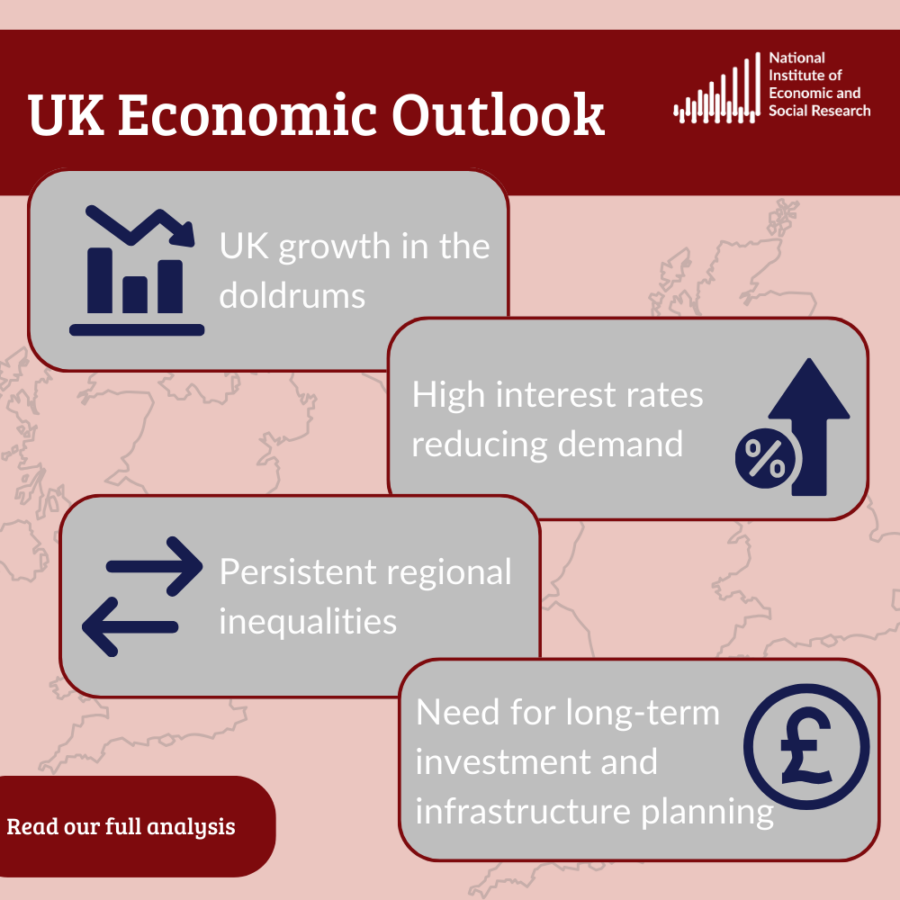

GDP growth remains sluggish in 2023 and 2024 as the monetary policy tightening continues to bite. We expect GDP growth of 0.6 per cent in 2023 and 0.5 per cent in 2024.

Pub. Date

Pub. Date

08 November, 2023

Pub. Type

Pub. Type

Main points

- We think the MPC has done enough to bring CPI inflation back down to target, which it reaches towards the end of 2025. We think interest rates have peaked at 5.25 per cent and do not expect any cuts in rates until late next year. When interest rates do come down, we expect them to reach between 3 and 3.5 per cent, compared with the market’s current view of an equilibrium rate of just over 4 per cent.

- We expect wage inflation to remain high as workers attempt to bring their real wages back to where they were before the cost-of-living crisis hit. We expect average earnings to increase by 7.2 and 7.1 per cent in 2023 and 2024, respectively, but we do not expect this to feed into higher price inflation as firms have space to absorb these increases by lowering margins.

- Public-Sector Net Debt is falling as a percentage of GDP throughout our forecast and the deficit to GDP ratio falls below 3 per cent by 2027/28, in line with the fiscal rules. This means that there is some limited fiscal space in 2024, which we feel should be used to increase public investment – particularly in infrastructure and housing – rather than to cut taxes.

- We project that the living standards for people in income deciles 2-5 will not return to pre-pandemic levels until the end of 2026: real household incomes are growing more strongly in 2023, but real wages fell the most for the poorest in 2022.

- The number of destitute people will fall to around 1.1 million by the end of 2024, including 300,000 children. We project that destitution – ie, going without the essentials everyone needs to eat, stay warm and dry, and keep clean – will fall from around 1.5 million to approximately 1.1 million, largely as a result of increasing real wages in 2024.

- There are significant economic benefits from raising the National Minimum Wage and the National Living Wage. We find that households in the bottom income decile will see a 5-6 per cent rise in their consumption in 2023-24 as a result of rises in the National Minimum and Living Wages.

- Addressing London’s productivity paradox – despite having the highest level of productivity in the United Kingdom it has the slowest productivity growth except the South-West – requires an overarching strategy. Much better coordination across multiple tiers of government (Westminster, GLA, and the boroughs) is needed to design targeted investment and deliver more affordable housing, better access to transport, higher R&D spending and greater business investment.

See our previous UK Economic Outlooks to follow the analysis